GAAP helps provide clear information on your business’s financial health. If your business is small, you might choose to handle the accounting yourself rather than hiring an accountant, and only seek professional when it’s time to prepare taxes. But regular sound professional advice is invaluable and can make your business successful. Every business owner needs to have a structured method of bookkeeping that records the money coming in and going out of the business. This will help you monitor revenue and expenses, track budgets, fulfill financial obligations, and take action if problems arise. Bookkeeping involves tracking financial records such as income, deductions, credits, and expenses accountant for startups on a weekly or monthly basis.

How The Second City expedited expense management and gained financial control with Ramp

Review all deadlines set by the Texas Secretary of State and your local authorities. Regularly updating your business plan and performing periodic market research ensures you remain competitive. Local Chambers of Commerce often host events and webinars focused on business development. Organizations like SCORE and the SBDC provide mentorship, counseling, and training sessions, frequently at no cost. Industry-specific associations—like the Texas Restaurant Association or Texas Retailers Association—can connect you with suppliers, advisors, and potential partners.

- Our CPAs are experts in startup accounting, and are experienced in leveraging AI accounting tools and automation.

- Invoicing, expense categorization, and even payroll processing can be automated, saving valuable time and reducing the risk of human error.

- Our team makes sure you are ready to fly through your next VC’s accounting, HR and tax due diligence.

- Here are the things to look out for when looking for an accountant for startups.

- Applying is free of charge and can be one online, through fax, email, or phone.

- Zoho accounting software is part of the suite of products for businesses offered by Zoho.

- Knowing it’s time to pay a supplier won’t do you any good if you don’t have sufficient funds in your account.

Accounting and Bookkeeping Services for Startups

Bookkeeping focuses more on the daily financial operations of an organization, which includes recording transactions, reconciling statements and managing payroll. Manual accounting is tough to stay on top of and prone to human error. That’s why investing in startup accounting software is a good idea. Plus, this software https://www.bookstime.com/articles/how-to-set-up-a-new-company-in-quickbooks can create invoices, pay bills, add ledger entries, reconcile bank accounts, and generate financial statements. When you have accurate financial statements, like balance sheets, cash flow, and profit and loss statements, you can see where your startup stands financially. It also tells you where you’re making money and helps you plan for business growth.

Prepare your financial statements

When drafting, pay special attention to your financial forecasts, operational structure, and marketing strategy. This ensures you have a viable model and can adapt quickly to market changes in Texas’ dynamic environment. Taking the pain out of accounting so you and your business can concentrate on slaying the world (or whatever your plans happen to be). User-friendly interfaces and quality customer support can make a huge difference, especially if you lack a dedicated accounting department. Look for apps with positive reviews regarding ease of use and robust customer service.

The Accounting Equation

After securing your EIN, open a separate business bank account to keep personal and business finances distinct. Most banks in Texas, like Frost Bank, Comerica, or regional credit unions, offer small business checking packages with reduced fees. Using reliable accounting software—QuickBooks, FreshBooks, or Xero—helps streamline bookkeeping, tax filing, and payroll management. An international startup with employees traveling across multiple countries adopted Expensify to simplify its expense management process.

What Documents Do You Need To Complete Your Startup’s Tax Return?

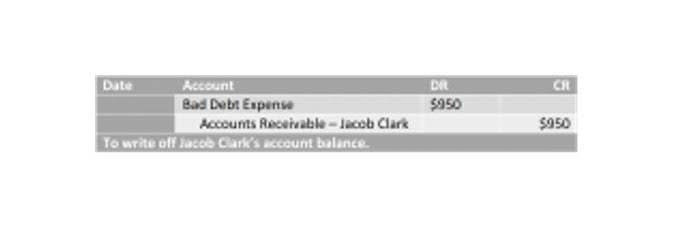

One key difference is that a million-dollar business can hire an accounting team, while startups don’t have that luxury. In a new company, you may need to be your own startup accountant to keep expenses down. Invoices are documents that list products and services businesses provide to their retained earnings clients. The client has an obligation to pay the business for services rendered or goods sold.